The future of decentralized exchange: cryptocurrency, tron and liquidity provider **

In the rapidly developing world of cryptocurrency, decentralized stock exchanges (Dexs) have proven to be a player for dealers and investors. These innovative platforms include Tron (TRX), a modern blockchain-based ecosystem that combines the performance of cryptocurrency with the efficiency of traditional trading systems. In this article we will examine how Trons Defi (decentralized financing capacities) and liquidity providers revolutionize the future of decentralized exchange.

The rise of the decentralized exchange

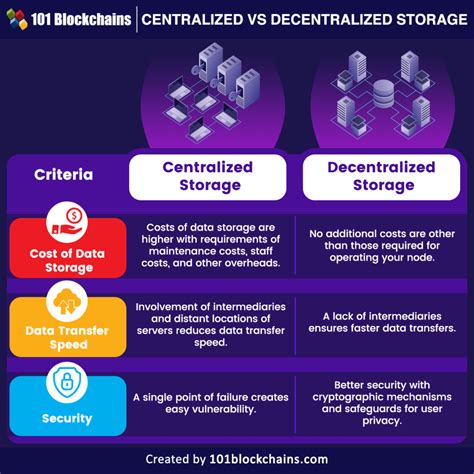

The decentralized exchange has gained in recent years and offers a safer, more transparent and more efficient way to buy, sell and act cryptocurrencies. However, these platforms often rely on centralized stock exchanges (CEXS) for liquidity provision, which can lead to market manipulations, high fees and reduced market depth.

Trons Defi functions

Tron, supported by the Tron Foundation, a non-profit organization that is supposed to create a decentralized Internet ecosystem, has developed a robust series of defi functions. This includes:

- Liquidity provider : The Defi platform from TRON enables liquidity providers to submit TRX in exchange for stable coins (e.g. USDT, DAI) and to cancel, which offers an alternative source of financing for decentralized stock exchanges.

- Decentralized market production : Tron’s Market Making Services enable liquidity providers to achieve income by corresponding to buying and selling, which reduces the need for central market manufacturers.

- Orakel : The Oracle network from Tron offers real-time price data from leading cryptocurrency exchanges and enables seamless integration into traditional financial systems.

Liquidity provider in action

Tron has teamed up with various liquidity providers, including:

- Uniswap : A popular Defi protocol that offers liquidity services for decentralized stock exchanges.

- Curve : A stable coin-based lending platform that offers liquidity for the defi ecosystem from Tron.

- KUCOIN : One of the largest cryptocurrency exchanges in China, which Trx integrated into its liquidity provider network.

Advantages of the Defi skills of Tron

The integration of Defi functions to Tron offers users several advantages:

- Increased market depth : Liquidity providers can provide a larger capital pool, increase the depth of the market and reduce volatility.

- improved security : The decentralized exchange can benefit from advanced security measures such as multi-signature money exchanges and intelligent risk management.

- Competition advantage : The Defi functions of Tron enable users to gain an advantage over traditional central exchanges in terms of liquidity determination.

Challenges and opportunities

While the defi skills of Tron have the potential to revolutionize decentralized exchange, there are also challenges to overcome:

- scalability : If the number of users increases, the platform must improve its scalability in order to maintain performance.

- Regulatory compliance

: Tron must navigate as a blockchain-based ecosystem in complex regulatory landscapes and ensure compliance with the regulations against money laundering (AML) and Kenne-Your Customer (KYC).

Diploma

The defi skills and liquidity providers from Tron are ready to disturb the future of decentralized exchange. While the cryptocurrency market is developing, it will be exciting to see how Tron adapts to the changing needs of users. With its robust defi platform and partnerships with leading liquidity providers, Tron is well positioned to become an important player in the global cryptocurrency industry.

get ready for the future

If you are interested in Trons Defi -Ecosystem, examine:

- Tron Wallet : A user -friendly wallet with which users can save, send and receive TRX.

2.