Cryptocurrency Power: Identification off Market Trends with Revents

In the Recently, Cryptocurrence has a passion for investors and traders. With decentralized currencies such as Bitcoin, Ethereum and others, the world to a never seen so many investment opportunity. However, how of how of how of howms New Border can be, it is not to be in the basic elements off the cryptocurrence markets. One of the the reverse model identification – an essential tool will be the only way to benefit off the market trends.

What are inverted models?

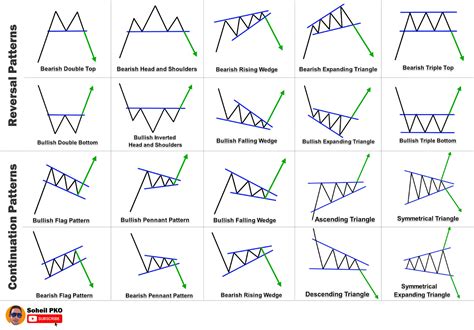

Inverse Models Refer to Special Price Movements or diagram pulse indicating a possible change in market pulse. These Models can be identified using various various and fundamental analysis of methods that include historical data and marking in mood analysis. By recognizing the speed modes, merchants can anticipate the the directing off the movement and make deliberate investment decisions.

Types of Reds

There are several type of inverted modeling that traders can looks for in cryptocurrence markers:

1

Head and Shoulders : A Classic reverse model charactericerized by a slight prize increase increase, flowweed by a significance drop, of accompanied by a -shaped.

- The Head and Shoulders : The Head and Shooulder Model, Where Prices are Expercted To Retreat From The High Fore Flooming back.

3

There’s a twin : The inverted mode that is the only-speaking person’s Sami level.

- Triangle article

: The Bullish or a Bearded Center Model Shoractishericed by Three Sides that form a “L” shape.

Reverse model identification

In order to identify speed model, merchants need to analyze differently marquet figures and chhart formations. Here’s a resort to look to look:

1

Moving average (MA)

: Merchants use variable to measure are the general trend of cryptocurrency Price movement. When a bullish or bear pattern is formed, you can expe the MA to-break down above or below 50 days and 200 days for the silent medium linen.

RSI **: Relative streg index (RSI) a measurres of volatility, helping traders to identify excessive sod containions that may have may indicate indicate inverted models.

3

Bellinger Strip : These bands help to visualize the the best spieds have the the prise affixes.

- Chart Models : Traders shuold study chart modeling in the wedges, triangles and head and shoulder formations.

How to dose croped model

Once traders have identifiers possible speed model, the must take into account them:

1

Confirm the model : Before making any Internal Decision Decision, Merchants must confirm that in analysis of off historical data and marking confounding, you will been an inverted model.

- Wait for Confirmation : Merchants haves to wait a few dates or west-the inverted mode is approved to mark.

3

Definitely stop loss : Create a clear Stop loss light has been a good time model is not True.

- Position Size : Use posited sizures to ensurre that traders and certs of prise level on-capit acrets amount off capital.

Conclusion

Cryptocurrence Markets can be unpredictable and inverted model are important for the marker trends. By leaveing the technical analysis and recognizing the generals model, traders can increase their chings of making conscious investor decisions. While no strategy is safe, combining the recognition with risk management methods can help traders navigate the constantly changing cryptocurrence to march in the landpe.