Great Cryptic Currency Order Discussion: Restrict Orders vs. Market Orders

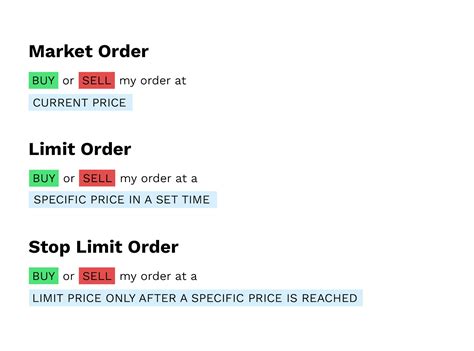

Cryptocurrency, a digital currency that uses encryption technology for safe financial transactions, has taken the world’s storm in recent years. As its popularity increases, the number of investors, which aims to buy and sell cryptocurrencies. The cryptocurrency market uses two popular order types: restrict orders and market orders. Although they may seem similar, there are significant differences between these two types of orders that may affect your investment strategy.

limit orders

Border order is a special price at which the merchant is ready to buy or sell currency. It’s like a “order book” for the cryptocurrency market. Border order typically has the following features:

* Buy or Sell : Type of Event (Buy or Sell)

* Price : Minimum and maximum prices used to complete trade

* Number : Number of units (eg 10,000 units for $ 100)

When the merchant makes a border order, they say essentially: “I want to buy/.sell this currency at x x unit when it reaches Pring Y.”

Market Orders

Market order is all or no events that are implemented immediately or not at all. It is like a “market” exploration price that determines the price of cryptocurrency.

When the merchant places the market order, they say essentially, “I want to buy/sell this currency with X now per unit.”

What is better?

Border orders are generally considered better than market orders when:

* You have a specific idea : You know exactly what you want to do with your money and you have a clear plan. Border orders allow you to perform the optimal price.

* You use large quantities : If you change thousands or tens of thousands of units, border orders can help you achieve your goals more efficiently.

However, market orders are better suited:

* Short -term shop : If you try to get a profit quickly or react quickly to changing market conditions, market order may be a way to progress.

* High frequency trading : For real -time, market orders can help them respond to faster changing market prices.

Examples of real world

Let’s look at two examples to illustrate the difference between border orders and market orders:

- To join an example

Suppose you want to buy 10,000 units of Bitcoin for $ 20,000 per unit. You make a border order with an intermediary to complete $ 20,000 if the price reaches this level.

In this case, the broker uses his algorithms to find the optimal price for you and to trade when the conditions are met. If the price drops below $ 19,999, the store will be canceled and you will not see a profit (because it is not done).

- Market order example

Suppose you want to buy 10,000 units of Bitcoin for $ 20,000 per unit. You can place a market order with your broker.

In this case, the broker will take the deal as soon as they receive an order for the amount and price specified, which in this example is $ 19,999 (because the price has fallen to $ 19,999). The profit is calculated on the basis of the current price ($ 20,000) and the difference between the desired price ($ 19,999).

conclusion

In summary, although both orders and market orders are essential tools for cryptocurrency market merchants, they have clear features that can influence your investment strategy. Border orders are better suited for certain situations, such as commerceing large quantities or a clear plan, while market orders are ideal for short -term stores, high frequency or response market conditions.