Tokenomy Understanding: Key Administration -Funds and Market Dynamics Assessment

The cryptocurrency world has experienced rapid growth in recent years, and numerous new tokens are launched daily. Although many investors are drawn to the potential of these digital assets, an important aspect that is often taken into account is tokenomics, a blockchain-based system of economics and design. Tokenomic plays an important role in assessing the administration of administration and understanding the dynamics of the market.

What is tokenomics?

Tokenomics is a multidisciplinary field that combines economics, information technology, mathematics and sociology to understand how digital funds are created, distributed and used on the Blockchain network. It includes the design of the protocol, with its other tokens and its impact on the dynamics of the market.

Supervisory marks: Key to understanding market dynamics

Supervisory signs, also known as benefit marks or safety signs, have become increasingly popular in recent years. These codes are designed to be used on the Blockchain network, but often lack traditional administrative structures that support public block chains, such as Bitcoin and Ethereum. However, administrative chips provide investors with a unique opportunity to participate in decision-making processes and modify the project direction.

In order to evaluate the management class, it is necessary to take into account several key factors:

- Tokenomics : Design of Token, including the underlying protocol, voting mechanisms and character distribution.

- Market Feelings : How do investors detect the ID including their expectations for future commissioning and use cases.

- Community Commitment : The level of community and project team activities and interaction.

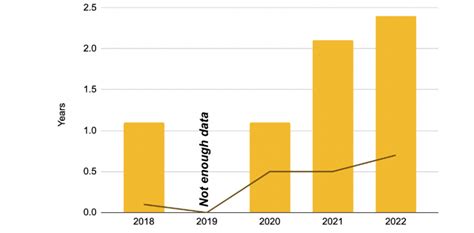

- Acceptance rate

: Percentage of users or organizations using Token over a particular period.

Key Tokenomics Meters to Watch

When evaluating administrative marks, it is necessary to monitor several key indicators:

- Token Price : Stable or unstable markets can indicate investors’ confidence and deployment.

- Voting Power Distribution : Tokens with high voting power may be more influential in decision -making processes.

- Safety ID rating (STC) : STCs are a kind of security instrument that provides protection against prices.

4

Understanding the Token Offering

The total amount of cryptocurrency is fixed, but it is often divided between several tokens within the project. This concept is known as Tokenomics. Understanding the sharing of characters can affect market dynamics:

- Token distribution : A well-designed distribution strategy can increase deployment and credibility.

- Token Survey : Limited brand delivery can create a sense of urgency or exclusive right.

Market: Psychology of Investments

Investors often react emotionally to market feelings that are influenced by different factors such as:

- News and rumors : Unjustified information can create hype or fear among investors.

- Social media commitment : Active presence of social media can increase the visibility of the ID.

- Acceptance rate : Successful adoption can lead to increasing the confidence of investors.

conclusion

Understanding Tokenomy is crucial to evaluating the dynamics of administration and markets. By analyzing branding, market feelings, community commitment and other factors, investors can make more conscious decisions about their investments. The distribution of the Token supply, the scarcity of the brand and the opinions of the market are all important roles in the design of the project’s overall success.