The Importance of Liquidity Pools in Cardano (ADA) and Risk Management

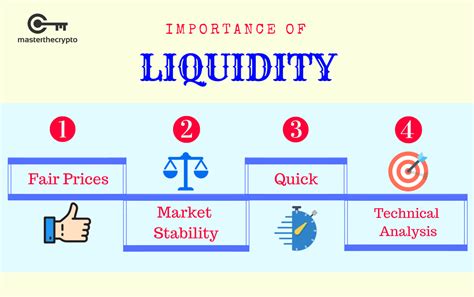

Cryptocurrencies However, a crucial aspect that often gets overlooked is the importance of liquidity pools in cryptocurrency markets. (ADA) and explore how they Impact Risk Management.

What are Liquidity Pools?

The liquidity pool is an on-chain liquidity provision mechanism that allows users to borrow or lend their ada tops without having to interact with a centralized exchange. This Technology

Why are Liquidity Pools Important in Cardano (ADA)?

Cardano (ADA) is one of the most promising cryptocurrencies on the market, with a strong focus on scalability, security, and decentralization. One of the key features of ada that sets it apart from other cryptocurrencies is its use of liquidity pools.

Benefits of Liquidity Pools in Ada:

- Increased trading volume : by providing a pool of liquidity, traders can increase their trading volume,

- Reduced volatility :

*

How do Liquidity Pools Work on Cardano (ADA)?

“Adast”. The promise of returning it at a state rate. .

Risk Management

Liquidity pools also play a crucial role in Risk Management on Cardano (ADA). Helping with traditional exchanges.

1.

2.

3.

Conclusion

(ADA) By reducing volatility, improving market efficiency, and enhancing risk management, liquidity pools have the potential to become a game-changer for the cryptocurrency space.

The adoption of cryptocurrencies continues to grow You

Disclaimer: Cryptocurrency markets are inherently volatile, and past performance is no guarantee of future results.